Aruban Economy Continues to Tank; Debt runs up to 1.9 dollars

What is the cause and effect of a declining economy, loss of tax revenue and no  change in government spending? Aruba is find out. Less tax revenues result in a need to cut programs or risk an out of control debt. No wonder Aruba had been budgeting less for tourism. However, with the new tourism fund, that will siphon even more money away from the general fund and only allocate it for tourism marketing.Â

change in government spending? Aruba is find out. Less tax revenues result in a need to cut programs or risk an out of control debt. No wonder Aruba had been budgeting less for tourism. However, with the new tourism fund, that will siphon even more money away from the general fund and only allocate it for tourism marketing.Â

According to the Bank, there is instability in the economy and the financing deficit of last year was much higher than budgeted. “Due to small-scale and the unilateral economy, the risks of the continuing deficits become higher and higher.”Â

In order to cover the financial needs, the government borrowed 378 million florins. About half of this was used for the refinancing of the matured loans, which caused the outstanding debts of the government to increase to 1.862 milliard florins, about 46 percent of the estimated gross national product of 2005.Â

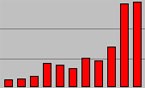

The following are the Aruban deficits numbers for recent years (Ignoring the oil sector & the free zone):

- 2005: 309 million florin deficit

- 2004: 237 million florin deficit

- 2003: 346 million florin deficit

- 2002: 233 million florin deficit

Anyone want to make any guesses as to what it will be in 2006 as tourism is down 18%? With hotels, restaurants and casinos not being frequented by tourists in large numbers in 2006, where does Aruba expect to generate tax revenue from? Cruise ship passengers do not generate enough revenue to even come close to replacing this gaping hole.

According to the Bank, the public- as well as the private sectors are constantly spending more money on imports that what is exported. “No economy can maintain continuous large deficits on the current account on the long term”, warns the Bank. Certain budgeted revenues did not realize, which caused the financing deficit to be higher than budgeted. A reason for this was that the planned environment tax was not introduced, and the citizens didn’t need to pay for garbage pick up yet. Another draw back was that the profit tax yielded less money than was anticipated.

What does the future have in store for the Aruban economy? The decline in tourism has been continual and worse with every passing month and quarter. Aruba has yet to announce the April, May and June numbers which most probably will be no different. Come 2007, Carnival Cruise has also stated that they will no longer be using Aruba as a port of call.

Aruba has waited for too long to effectively deal with this problem as they expected the Natalee Holloway situation “to go away in a couple of days”. They may want to rethink that strategy in the future. They best find a way to cut social programs and other spending because this down trend in the economy is not going to be changing any time soon.

Read the full Amigoe story (7/21/06):

Â

Debt runs up to 1.9 dollarsÂ

ARUBA — From the 2005 annual report of the Bank that was presented to the media this morning is concluded that the Central Bank of Aruba is concerned about the developments of the balance on the current account of the government. According to the Bank, there is instability in the economy and the financing deficit of last year was much higher than budgeted. “Due to small-scale and the unilateral economy, the risks of the continuing deficits become higher and higher.”Â

In order to cover the financial needs, the government borrowed 378 million florins. About half of this was used for the refinancing of the matured loans, which caused the outstanding debts of the government to increase to 1.862 milliard florins, about 46 percent of the estimated gross national product of 2005.Â

Ignoring the oil sector and the free zone, the balance of the current account of the economy of December 2005 shows a deficit of 309 million florins. Last year’s budget assumed a deficit of 81 million florins, which means that a considerable deficit is observed for four consecutive years. This deficit was 233 million florins in 2002, 346 in 2003, and 237 in 2004.Â

According to the Bank, the public- as well as the private sectors are constantly spending more money on imports that what is exported. “No economy can maintain continuous large deficits on the current account on the long term”, warns the Bank.Â

The government resorted to supplemental financing during the last part of the year. The high expenses and loans of the government led to more money in the economy. Together with the big demand on banking credits, these handlings had a negative effect on the balance of payments and the international reserve position of Aruba.Â

Certain budgeted revenues did not realize, which caused the financing deficit to be higher than budgeted. A reason for this was that the planned environment tax was not introduced, and the citizens didn’t need to pay for garbage pick up yet. Another draw back was that the profit tax yielded less money than was anticipated. The deficit on the AZV was also not taken into account in the budget. The deficit grew fast since the expenses were not adjusted to the diminished revenue. Â

The government spent 94 percent of her revenue on current matters, like salaries, AZV, pension premiums, interest, goods, and services. The current expenses were therefore higher than the total tax revenue. The Bank advises the government to adjust the pattern of spending. Soon, the government will have to keep the increase of the salaries under control; reduce the expenses for goods and services; and continue with the plans to change the pension scheme for civil servants

If you liked this post, you may also like these:

Comments

Leave a Reply

RSS

RSS